Form 1098-T- Education Credits and Deductions

Here is a comparison of the American Opportunity Credit (AOC) and Lifetime Learning Credit (LLC). Taxpayers may claim either type credit for each student on the return but cannot claim both credits for one student. Use the table below to determine the best possible tax savings. (Note that the Consolidated Appropriations Act of 2020 consolidated the Modified AGI ranges for both the AOC and the LLC, eliminating the differing income range phase-out.)

Tax Year 2020 Education Benefits Comparison

| Criteria | AOC | LLC |

| Maximum benefit | Up to $2,500 credit per eligible student | Up to $2,000 credit per return |

| Refundable or nonrefundable | 40% of credit (refundable) | Not refundable (once the tax liability is reduced to zero, no further credit is available). |

| Limit on MAGI* for married filing jointly | Phase-out begins $160,001 phasing completely out at $180,000 | |

| Limit on MAGI* for single, head of household, or qualifying widow(er) | Phase-out begins $80,001 phasing complete out at $90,000 | |

| If married can you file a separate return? | No | |

| Dependent status | Cannot claim benefit if someone else can claim you as a dependent on their return. | |

| Can you or your spouse be a nonresident alien? | No, unless the nonresident alien is treated as a resident alien for tax purposes (see Publication 519 for information on nonresident alien status) | |

| Number of years of post-secondary education available | Only if student hasn't completed 4 years of post-secondary education before 2020 | All years of post-secondary education and for courses to acquire or improve job skills |

| Number of tax years benefit available | 4 tax years per eligible student (includes any years former Hope credit claimed) | Unlimited |

| Must the credit be claimed in consecutive years? | You are not required to claim a credit for a particular year. | |

| Type of program required | Student must be pursuing a degree or other recognized education credential | Student does not need to be pursuing a degree or other recognized education credential |

| Number of courses | Student must be enrolled at least half time for at least one academic period beginning in 2020 | Available for one or more courses |

| Felony drug conviction | Student must have no felony drug convictions as of the end of 2020 | Does not apply |

| Qualified expenses*** | Tuition, required enrollment fees, and course materials needed for course of study | Tuition and fees required for enrollment or attendance |

| For whom can you claim the benefit? | • You • Your Spouse • Student you claim as a dependent on your return | • You • Your Spouse • Student you claim as a dependent on your return |

| Who must pay the qualified expenses? | • You • Your Spouse • Student • Third Party** | • You • Your Spouse • Student • Third Party** |

| Payments for academic periods | Made in 2020 for academic periods beginning in 2020 or the first 3 months of 2021. | |

| Do I need to claim the benefit on a schedule or form? | Yes, Schedule 3 of Form 1040 and Form 8863, Education Credits | Yes, Schedule 3 of Form 1040 and Form 8863, Education Credits |

* Modified Adjusted Gross Income (MAGI)

MAGI is normally the taxpayer's AGI modified by adding back the following:

- Foreign earned income exclusion

- Foreign housing exclusion

- Foreign housing deduction

- Exclusion of income by bona fide residents of American Samoa

- Exclusion of Income by bona fide residents of Puerto Rico

Worksheets are available in Publication 970 to assist in this calculation.

** Third Party qualified education expenses

Third-party qualifying education expenses are qualifying expenses paid by a third party on behalf of the student claimed as a dependent on the return that the taxpayer would have otherwise paid. Payments by third parties include amounts paid by relatives or friends.

*** Adjustments to Qualified Education Expenses:

Qualified expenses are always adjusted by tax-free educational assistance received, and the balance is used to calculate the credit.

The following expenses do not qualify for the AOC or the LLC:

- Room and board

- Transportation

- Insurance

- Medical expenses

- Optional student fees, i.e., fees not required as a condition of enrollment or attendance

- Expenses paid with tax-free educational assistance

- Expenses used for any other tax deduction, credit, or educational benefit

Qualifying expenses aren't reduced by the following:

- Payments for services, such as wages

- Money received from loans

- Gifts

- Inheritances

- Student's personal savings

- Certain scholarships or fellowships are reported as income on the student's tax return that:

- restrict the use of the funds to costs of attendance that are not qualified expenses, e.g., room and board; or

- are unrestricted and may be used for any expense.

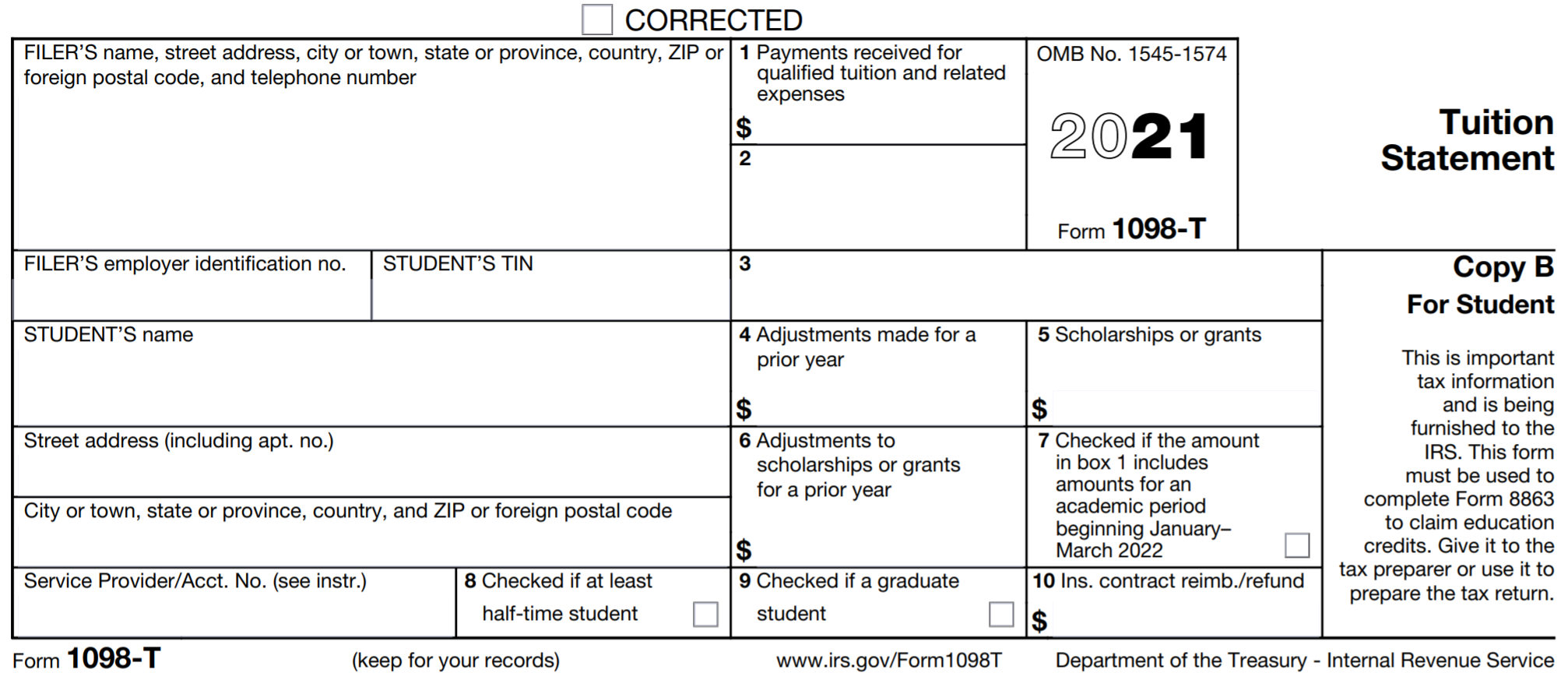

How to Read the 1098-T

Box 1 – Payments received by the institution that covered qualified expenses.

Box 4 – Adjustments made in the current year to prior year reporting. This can be adjustments to amounts previously billed or additional payments received.

Box 5 – Scholarships and/or grants received on behalf of the student. These can be from the institution or from third parties, e.g., civic and religious organizations. This amount does not include any payments from family or loan proceeds.

Box 6 – Adjustments made in the current year to prior year scholarships and grants that were previously reported.

Box 7 – Check the box that indicates that the Box 1 amount includes payment for an academic period that begins during the first quarter of next year.

Box 8 – Check the box that indicates that the student is at least a half-time attendee.

Box 9 – Check the box that indicates that the student is a graduate student. (Graduate students are eligible for the LLC, not the AOC.)

Box 10 – This box is completed by an insurer that has reimbursed a student for expenses through a "tuition insurance" policy. This typically occurs when the student withdraws for medical reasons, a family emergency, etc. (This amount will reduce the credit being calculated.)

What if the student did not get Form 1098-T?

The IRS requires that forms be sent to students by January 31st. If the student did not receive one, they should check with the institution. The preparer can still complete the forms required for claiming the credit but will need to have evidence, such as receipts and proof of payment, available for the IRS upon request. We suggest attaching a preparers' note to the return, including a list of expenses.

What if the taxpayer has qualified expenses not included on Form 1098-T?

Documented and verifiable qualified expenses not included on Form 1098-T can be added to the total, bearing in mind that the burden is on the taxpayer to demonstrate that the additional amount qualifies and is not included on Form 1098-T.

Related Articles

Form 8867 - Due Diligence for Claiming the American Opportunity Credit

For each student who qualifies for the American opportunity credit, the taxpayer may be able to claim a credit of up to $2,500 for the adjusted qualified education expenses. The credit equals 100% of the first $2,000 and 25% of the next $2,000 of ...Form 8867 - Earned Income Credit Due Diligence

Paid preparers of federal income tax returns or claims for refund involving the Earned Income Credit (EIC) must not only ask all the questions required on Form 8867 but must meet the due diligence requirements in determining the taxpayer's ...Inputting A Form W-2 With More Than 4 States Listed

Each Form W-2 entry screen has enough space for four states to be listed. If a client's Form W-2 has more than four states listed, you will need to divide the W-2 into two or more separate entries. For example, if there are seven states listed on the ...Can I Prepare Their Tax Return Based Off Of Their Last Paystub?

According to the IRS: "Authorized IRS e-file Providers are prohibited from submitting electronic returns to the IRS prior to the receipt of all Forms W-2 ... and 1099-R from the taxpayer. If the taxpayer is unable to secure and provide a correct Form ...Where Can I Get A List Of The Codes That Are Entered In Box 12?

There are several types of compensation and benefits that can be reported in Box 12 of Form W-2. Box 12 will report a single letter or double letter code followed by a dollar amount. The following list explains the codes shown in Box 12 of Form W-2. ...