Form 2441 - 2021 Changes to the Child and Dependent Care Credit

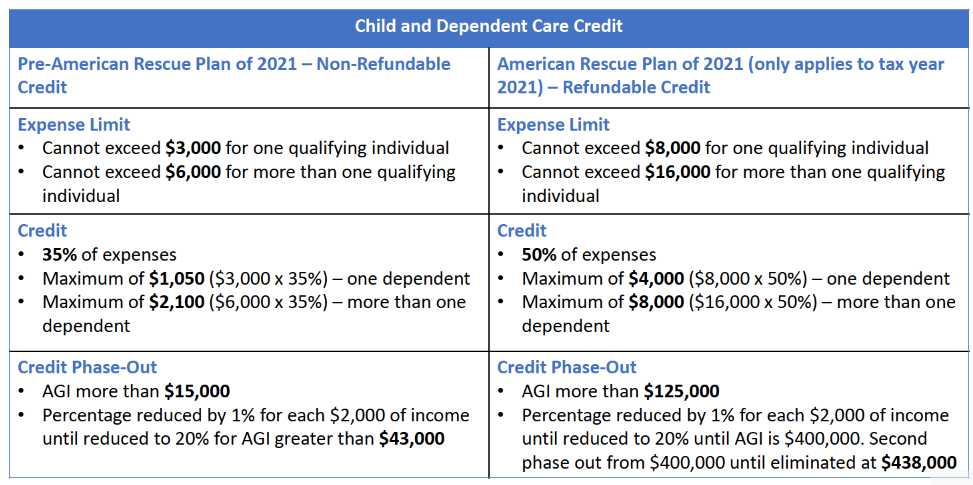

For 2021, the American Rescue Plan Act has made changes to the credit for child and dependent care expenses reported on Form 2441.

- The credit is fully refundable for taxpayers meeting residency requirements*

- The amount of qualifying expenses has been increased to:

- $8,000 (previously $3,000) for one qualifying child or up to

- $16,000 (previously $6,000) for two or more qualifying children

- The maximum credit has increased to 50% of the taxpayer's employment-related expenses:

- $4,000 maximum credit for taxpayers with one qualifying child

- $8,000 maximum credit for taxpayers with two or more qualifying children

- The income phaseout amounts and credit have been increased to the following:

- 50% of expenses - Begins to phase out when the taxpayer's income exceeds $125,000

- The credit percentage is reduced by 1% for each $2,000 the taxpayer's AGI exceeds $125,000, The credit is reduced to 20% of expenses when the taxpayer's AGI reaches $183,000

- 20% of expenses - For taxpayers with AGI between $183,001 and $438,000

- 50% of expenses - Begins to phase out when the taxpayer's income exceeds $125,000

*The credit remains non-refundable for taxpayers whose place of abode was not in the United States for more than half the year.

U.S. military personnel who are stationed outside the United States on extended active duty are considered to have their main home in one of the 50 states or the District of Columbia for purposes of qualifying for the refundable portion of the credit.

Related Articles

Wisconsin Homestead Credit - Schedule H

The Wisconsin Homestead Credit is designed to lessen the impact of property taxes by providing a credit on the Wisconsin state income tax return. The credit is based on property taxes levied in the tax year, and is available to both property owners ...Form 8880 - Retirement Savings Credit

Form 8880 is used to figure the amount, if any, of your retirement savings contributions credit that can be claimed in the current year. Taxpayers may be eligible for the credit if they made contributions (other than rollover contributions) to a ...Form 8814 - Parents' Election to Report Child's Interest and Dividends

Parents may elect to include their child's income from interest, dividends, and capital gains with their tax return as long as the total taxable interest, dividends, and capital gains are less than $11,000. Once the total reaches $11,000, the child ...Form 8379 - Injured Spouse Allocation

An injured spouse is a taxpayer who files a joint return, and all or part of the portion of the joint overpayment (refund) is being, or is expected to be, applied against a legally enforceable past obligation of the other spouse. An injured spouse is ...Form 8396 - Mortgage Interest Credit

The Mortgage Interest Credit is a nonrefundable credit intended to help lower-income individuals own a home. A taxpayer may claim the mortgage interest credit if a qualified mortgage credit certificate (MCC) was issued by a state or local ...